Getting Married and Related Tax Issues (Part 2)

Getting Married and Related Tax Issues (Part 2)

Previously we discussed some things to consider when getting married. In this part we will discuss the specifics of actual Tax Filing Status and related issues to the choices made and how we can help.

Filing Married filing Separate

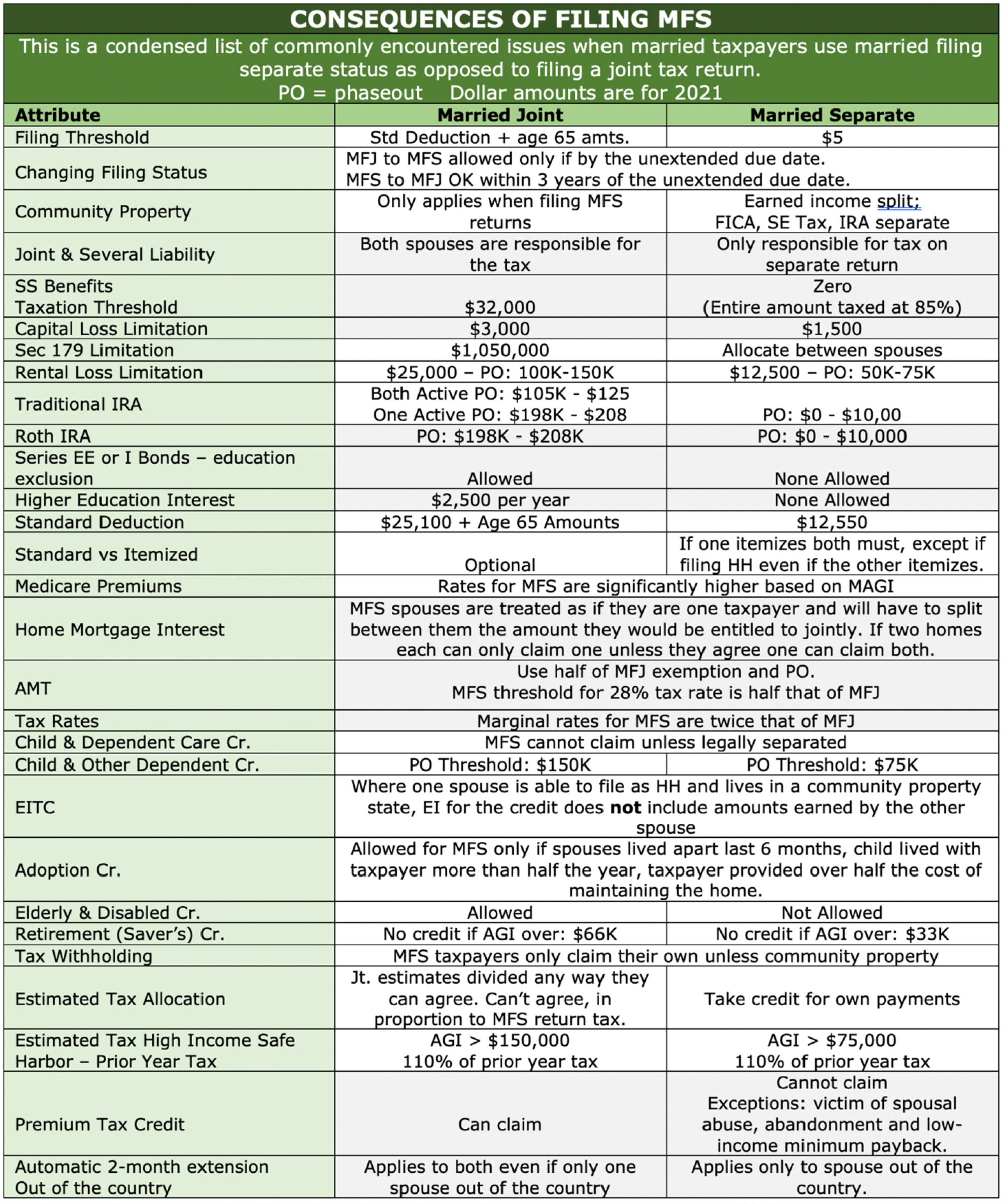

Some of the more relevant negative issues related to filing separately are outlined in the following chart:

Joint and Several Liability – There is always the possibility that one party to the marriage may owe back taxes, child support, or alimony from a prior marriage. If the newlyweds subsequently file a joint return each of them is legally responsible for the entire liability. Thus, any joint tax refund can be seized to satisfy those liabilities and is something that should be considered when making the filing status decision. There is a possibility that the souse that does not owe falls under the “injured spouse” protection. This would need to be discussed with the office to determine the best option for you.

Beware of Tax Scams – All taxpayers should be aware of and avoid tax scams. The IRS will never initiate contact using email, phone calls, social media, or text messages. First contact generally comes in the mail.

If you need assistance completing your new W-4s, adjusting estimated tax payments, determining which filing status is best for you or other tax issues related to getting married, please give this office a call.